‘Bitcoin’s value can go parabolic and hike by 27% IF these ranges…’ – Analyst

- One analyst believes BTC is positioned to revisit its all-time excessive

- Vital shopping for exercise from giant buyers, different key indicators supported this development

BTC’s latest restoration on the charts has been notable, wiping out earlier losses on the charts. In reality, it’s now displaying energy throughout all timeframes, with merchants and buyers seeing their portfolios flip optimistic following a 24-hour hike of three.42%.

Extra progress may very well be on the horizon although, particularly as additional evaluation appeared to focus on the potential for brand new ATHs.

Is $75,000 developing subsequent?

In keeping with analyst Carl Runefelt’s chart, Bitcoin’s latest positive factors adopted its rebound from a serious help degree between $52,250.33 and $50,647.52. This degree is important because it coincides with the underside of the descending channel wherein Bitcoin has been buying and selling recently.

A descending channel on a value chart usually indicators potential upward motion on account of larger liquidity driving the asset’s value greater.

Supply: X

In keeping with Runefelt, the convergence of those ranges may propel Bitcoin by 27.10%, reaching the higher fringe of the descending channel across the $66,000-mark.

In one other evaluation by Runefelt, he noticed that Bitcoin additionally shaped a descending resistance line.

Breaking this line may result in important positive factors. Runefelt added,

“It [BTC] could go parabolic.”

Supply: X

From the degrees indicated on his chart, this breakout may push Bitcoin to the following main liquidity zones between $72,000 and $74,000. Or doubtlessly even greater, relying in the marketplace momentum.

A spike in whale exercise bodes nicely for BTC

AMBCrypto additionally found a notable hike in whale exercise, one characterised by important fund inflows into the market. This could positively have an effect on Bitcoin’s value on the charts.

A standout transaction was MicroStrategy’s acquisition of 18,300 BTC between 6 August and 12 September. The agency’s newest transactions introduced its complete holdings to 244,800 BTC – That means, unrealized positive factors of $4.71 billion.

Moreover, different whales have additionally been lively. Just lately, one such investor acquired 1,062 BTC, rising their complete holdings to 10,043 BTC price $603.84 million.

Whale acquisition akin to this can be a signal of renewed confidence within the asset. Such confidence tends to extend the demand for the asset, on this case, BTC.

Furthermore, there was a surge in market liquidity by way of stablecoins. As an illustration, USDC’s Treasury lately minted 50 million USDC and transferred it to Coinbase, indicating rising demand as market individuals look to accumulate extra.

Throughout this era, there was additionally a important switch of $30,950,165 from Coinbase Establishment to Coinbase – One other signal of the underlying demand for liquidity to buy tokens.

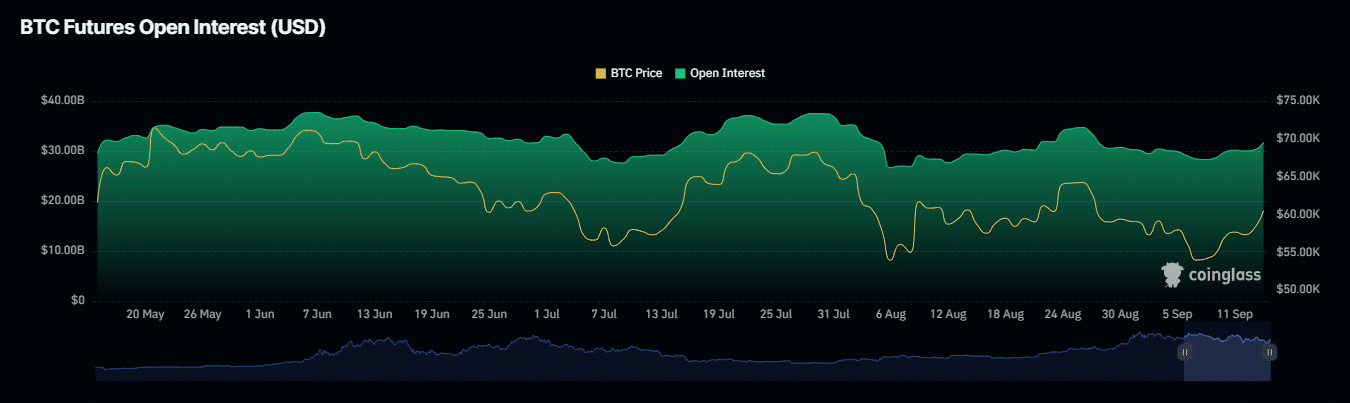

As whale actions persist, retail buyers have begun to reflect these shopping for patterns. In reality, based on Coinglass, Open Curiosity in BTC had climbed by 5.22% to $31.72 billion at press time – Its highest degree since early September.

Supply: Coinglass

Ought to this development proceed, the probability of Bitcoin climbing to greater value ranges will quickly seem more and more possible.

A brand new excessive is shut for BTC

Lastly, latest information from Coinglass on liquidations steered that quick merchants, who wager on the worth of BTC falling, have seen main losses.

In 24 hours alone, $48.81 million out of $55.1 million in brief positions have been forcibly closed as BTC surged previous $60,000. This development steered that the market is presently favoring bull over bear merchants.

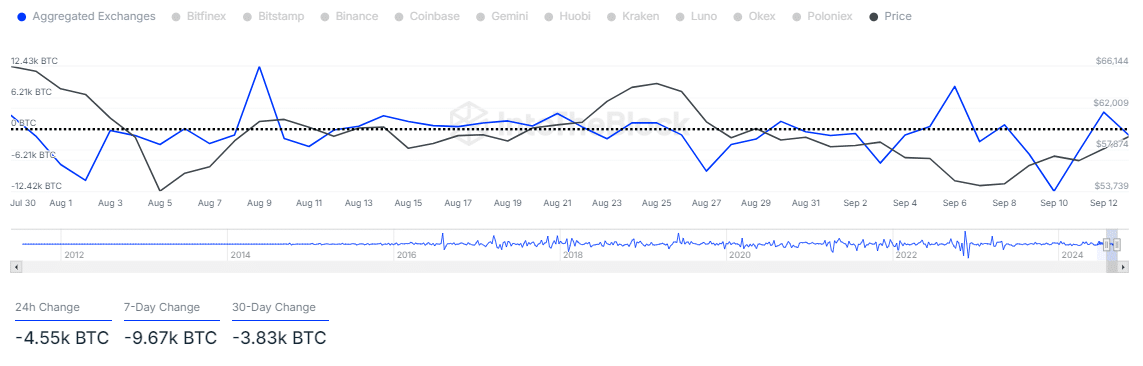

Moreover, there was a notable decline in BTC provide throughout varied exchanges. In reality, based on IntoTheBlock, the Trade Netflows for the previous seven days revealed a discount of 9.67k BTC and 4.55k BTC.

A fall in accessible BTC on exchanges typically results in a provide squeeze, which usually drives costs north.

If these metrics proceed on their present path, it’s probably that BTC will see additional motion upwards on the charts.

Supply: