Finest Crypto Lending Charges

If you happen to’re seeking to earn curiosity in your crypto – like incomes curiosity within the financial institution – you’ll probably need to do it by means of a crypto lending platform. Listed below are the very best charges as of June 2024:

| BTC | WBTC | ETH | USDT | DAI | USDC | |

| Nexo | 7.00% | – | 8.00% | 16.00% | 14.00% | 14.00% |

| Crypto.com | 5.20% | – | 5.50% | 5.20% | 6.50% | – |

| Coinloan | 6.00% | 6.00% | 7.00% | 9.20% | 9.20% | 9.20% |

| Binance Financial savings | 0.30% | – | 1.58% | 1.76% | 5.00% | 2.15% |

| Youhodler | 9.00% | – | 9.00% | 18.00% | 18.00% | 18.00% |

| Aave | – | 0.09% | 1.87% | 3.40% | 4.52% | 3.86% |

| Compound | – | – | – | – | – | – |

| Mango | – | – | – | – | – | – |

What’s Crypto Lending?

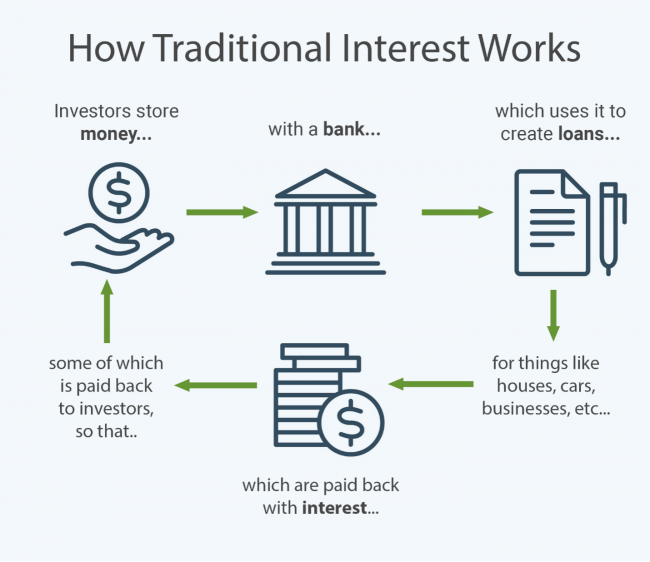

Within the conventional banking system, you retain your cash in a financial savings account, and the financial institution makes use of your cash to make loans. Because the loans are paid again (with curiosity), a few of that curiosity is handed alongside to you:

Crypto lending platforms work the identical method, besides you’re storing your crypto in a “lending platform” fairly than a “savings account.”

The distinction is that banks pay a mean of .06% curiosity, the place crypto platforms pays 6% or extra. That’s a 100x enchancment over banks.

Discovering the crypto lending platform, then, may also help your wealth be just right for you – however within the quickly altering world of crypto, it’s tough to belief. That’s why we’ve pulled collectively the very best crypto lending charges for you.

Kinds of Cryptocurrency Lending Platforms

There are two most important kinds of crypto lending platforms: centralized finance (CeFi) platforms and decentralized finance (DeFi) platforms. Consider CeFi like a conventional financial institution: there’s an organization behind the platform, so whereas they don’t seem to be regulated like a financial institution, they’re nonetheless answerable for your funds. DeFi platforms are extra just like the Web itself: fairly than one firm being in cost, it’s a distributed community of lenders and debtors, with blockchain-based good contracts dealing with all the cash.

CeFi Platforms

If you happen to select CeFi lending platforms like Coinbase or Binance, you entrust your crypto to a central entity or firm. Most CeFi platforms implement KYC (Know Your Buyer) and AML (Anti Cash Laundering) practices, and thus require shoppers to share private info. CeFi platforms function equally to on-line banks or conventional lending providers.

Regardless of the extra rigorous guidelines in contrast with DeFi platforms, many select CeFi providers as a consequence of comfort and usually larger rates of interest. CeFi providers present the safety that “someone is in charge,” and are additionally simpler to make use of. Additionally, some CeFi platforms allow customers to borrow fiat towards their cryptocurrency, with the fiat cash being despatched on to their banking accounts.

DeFi Platforms

DeFi platforms are web sites that deal with the lending and borrowing robotically, utilizing good contract-based algorithms. Usually you put in a Web3 pockets like MetaMask, then join it instantly right into a DeFi web site like Uniswap. (Watch our DeFi Arms-On Workshop for step-by-step walkthroughs.)

Lenders and debtors go to DeFi platforms as a result of they don’t require KYC verification, enabling customers to take care of extra privateness. Nevertheless, DeFi customers entrust their crypto funds to algorithms, which join on to their crypto wallets. There’s no “complaint line” if issues go incorrect.

Finest CeFi Lending Charges

Nexo

Nexo

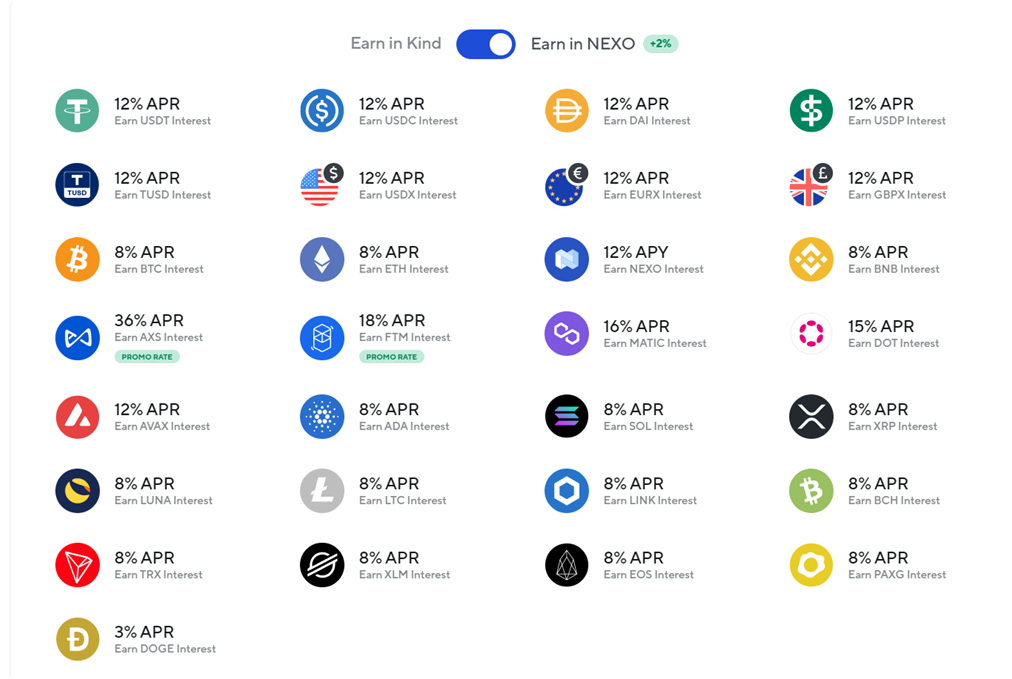

Nexo is without doubt one of the largest crypto lending platforms out there. Based in 2017, it boasts over $12 billion in belongings below administration, and over 3 million customers worldwide. In case you have by no means used a crypto lending platform, Nexo could also be the very best place to start out, as a consequence of its easy-to-use interface.

The APY on Nexo can attain as much as 18% on varied digital belongings. At this time, the platform helps 29 cryptocurrencies, together with BTC, ETH, BNB, ADA, LINK, DAI, DOGE, LTC, USDT, and USDC. The rate of interest on stablecoins is typically above 10%, far larger than conventional financial savings accounts.

U.S. prospects are not accepted.

Customers can even earn curiosity on fiat currencies – like a conventional financial institution – and borrow fiat towards crypto. Nexo helps USD, EUR, GBP, and a number of other different currencies.

Many buyers select Nexo as a result of it gives compound each day payouts, versatile earnings, and $375 million insurance coverage on all custodial belongings.

Customers who select to make use of NEXO – the platform’s native token – have further privileges, resembling higher rates of interest and extra free crypto withdrawals.

Crypto.com

Crypto.com

Crypto.com was based in 2016 and has grow to be one of many largest cryptocurrency providers. It offers alternate, non-fungible tokens (NFTs), cost, and lending providers to over 10 million customers worldwide. As well as, its belongings are backed by $750 million in insurance coverage. The truth that it was picked by Visa to settle transactions on the fintech big’s cost community tells so much about Crypto.com’s potential.

The platform’s Crypto Earn product has provided an APY of over 10%. In complete, about 40 digital belongings are supported, together with the native token Crypto.com Coin, which makes customers eligible for added rewards. If you happen to stake extra of the Crypto.com coin, you may obtain the next rate of interest.

CoinLoan

CoinLoan

CoinLoan is a specialised crypto lending platform launched in 2017. The platform allows customers to earn each day curiosity with their funds by no means being locked. On the time of writing, CoinLoan helps over 20 belongings, together with:

Stablecoins like USDC, USDT, TUSD, BUSD;

Cryptocurrencies like bitcoin, Ethereum, Ripple, Stellar, and Monero;

Fiat currencies, together with the pound and the euro.

The annual rate of interest for common cash like bitcoin and Ethereum is 7.2%, and it goes as excessive as 12.3% for stablecoins.

CoinLoan depends on a collection of safety measures to maintain the funds protected, together with insured custody, vulnerability scans, 2FA (two-factor authentication), safety alerts, and chilly crypto storage, amongst others.

Binance Financial savings

Binance Financial savings

Binance Financial savings is the crypto lending providing from the biggest crypto alternate on the earth by buying and selling quantity.

Binance gives two choices for its customers: versatile financial savings and locked financial savings. The previous permits buyers to easily deposit their crypto belongings and redeem the funds at any time. Locked financial savings are appropriate for individuals who are able to deposit their crypto funds for longer intervals. The wonderful thing about locked financial savings is that they arrive with larger rates of interest on most events.

It’s value noting that Binance offers excessive rates of interest on its proprietary stablecoin – BUSD, which is pegged to the US greenback. Depositors ought to anticipate an APY of 10% on BUSD with versatile financial savings. The rate of interest on USDC is simply 0.5%, as Binance regards Circle’s dollar-pegged stablecoin as a competitor.

Youhodler

Youhodler

Youhodler is a Swiss-based fintech platform targeted on crypto lending and alternate providers.

Customers can earn curiosity on deposits in BTC, USDC, TUSD, PAX, and extra. The curiosity is paid weekly, and the APY determine has rated from 5% for BTC and ETH, to over 12% for stablecoins. The minimal deposit quantity is $100 value of crypto.

The Crypto Loans service allows customers to borrow BTC, stablecoins, or fiat currencies towards 50 supported cryptocurrencies. Youhodler gives loans with 90% LTV for 30 days, 70% LTV for 61 days, and 50% LTV for 180 days.

Finest DeFi Lending Charges

Aave

Aave

Aave is without doubt one of the main gamers on the earth of DeFi. It permits customers to borrow and lend cash with out intermediaries. As talked about, no KYC or AML verification is required, which is true for all DeFi platforms listed right here: simply join your Web3 pockets and go.

Aave allows customers to lend and borrow in about 30 cryptocurrencies, together with ETH, USDC, DAI, and USDT. The protocol is fueled by the native token referred to as AAVE.

Listed below are the rates of interest for lenders and debtors:

Compound

Compound

Like Aave, Compound is without doubt one of the hottest and influential DeFi lending platforms; it sparked the preliminary DeFi craze again in 2020. Compound is extraordinarily user-friendly, and simpler for brand spanking new customers to navigate. The platform helps over 20 cryptocurrencies for lending and borrowing.

Moreover, Compound permits its customers to earn its native token, COMP, which provides holders the proper to take part within the governance course of (like shareholder voting in a conventional firm).

Alchemix

Alchemix

Alchemix is an attention-grabbing DeFi lending protocol, because it gives self-paying loans. For instance, a borrower deposits DAI to take a mortgage with as much as 50% LTV, which is disbursed within the type of alUSD, Alchemix’s native USD-backed stablecoin. The 50% LTV mortgage is ultimately paid off over time robotically utilizing the web returns from staking the preliminary DAI principal, which is staked by the protocol into one of many swimming pools operated by Yearn.

Thus, Alchemix is designed for debtors fairly than lenders. In a method, it lets customers borrow from themselves, because the loans are paid from the curiosity generated by the principal.

Mango

Mango

Mango is a decentralized cryptocurrency alternate that features a DeFi lending service. The latter is used to supply liquidity on the Mango market.

Customers can simply borrow a number of cryptocurrencies, together with the native MNGO token, and pay low annual rates of interest. Lending can be doable; nonetheless, the charges provided on most cryptocurrencies aren’t too aggressive.

Mango Markets protocol is at present not working (since October 2022), however a v4 improve is predicted to convey the platform again on-line within the first half of 2023.

The way to Choose the Finest Crypto Lending Platforms

Deciding on the proper crypto lending platform isn’t a simple process, contemplating the velocity with which the trade strikes. Nonetheless, there are a number of components that may assist:

- Longevity: Search for platforms which were round for at the least two years, with a rising person base. If they’ve reached this stage of “critical mass,” even when issues go incorrect, they’ll typically attempt to make it proper.

- Prices and charges: CeFi platforms might cost charges for withdrawals, accessing loans, and different operations, so examine all commissions and charges. Don’t neglect Ethereum fuel charges, which might eat away your income. (See our information on The way to Keep away from Crypto Charges.)

- Platform dangers: CeFi platforms are run by centralized entities, so you must guarantee they’re trusted and authorized to make use of in your nation. Within the case of DeFi platforms, be sure that they’ve a stable repute over at the least two years.

- Collateral Quantity: Observe how a lot debtors are required to place into the system as collateral, as this can be utilized to guard lenders within the case of market crashes. Search for collateralization of at the least 100% of what they’re borrowing.

- Minimal Deposit: Observe how a lot it is advisable to “buy in” to the platform. Use our Crypto Curiosity Calculator to determine what your actual rate of interest shall be, after taxes and charges.

What’s Crypto Lending?

Crypto lending is a sort of Decentralized Finance that acts as a bridge to permit buyers to lend cash to debtors in alternate for curiosity on the unique quantity. A crypto lending platform is, subsequently, the channel that connects the 2 events.

How Does Crypto Lending Work?

Like we’ve got simply seen, there are three main gamers within the crypto lending framework: lenders, debtors, and a platform that connects the 2.

- Lenders – These are buyers who need to earn passive revenue on their digital belongings. They lend their digital belongings to crypto lending platforms as a way to earn curiosity.

- Debtors – Debtors want funds and use their digital belongings as collateral to get a mortgage.

- Platforms – These are third-party platforms that might be both decentralized or centralized. They join the debtors to lenders and deal with the transactions.

DeFi vs. CeFi Lending: What’s the Distinction?

Although each DeFi and CeFi lending includes exchanging varied digital belongings, the platforms that facilitate them have totally different underlying infrastructure that determines whether or not the platform is centralized or decentralized.

DeFi Lending

In DeFi lending, transactions should not dealt with by individuals however fairly by good contract codes. Moreover, DeFi platforms are non-custodial, which means that solely the person can contact or management their very own funds.

Furthermore, many DeFi platforms don’t adhere to KYC (Know Your Buyer) or AML (Anti-Cash Laundering) rules, thus serving to their customers preserve anonymity and privateness.

DeFi Lending Professionals

- Peer-to-peer transactions with no third get together concerned.

- Consumer sovereign as solely the person has management over their belongings.

DeFi LendingCons

- Since there isn’t any centralized authority, DeFi platforms lack accountability. For example, shedding non-public keys will consequence within the lack of digital belongings since no middleman will intervene to assist restoration.

CeFi Lending

CeFi platforms emulate conventional banking infrastructure and rules, whereby third-party intermediaries hold custody of funds and revenue by lending funds to debtors. They moreover make sure that collateral is securely saved.

CeFi platforms combine KYC and AML, amongst different protocols, into their system.

CeFi Lending Professionals

- Regulatory protocols like KYC shield the integrity of the system from unlawful actions.

- Supply a broader vary of economic providers like direct assist for fiat currencies.

CeFi Lending Cons

- Customers must belief a 3rd get together with their funds.

Is crypto lending nonetheless protected?

The cryptocurrency market was shaken by the downfall of Celsius, one of many largest centralized crypto lending providers. With about $25 billion in belongings below administration as of October 2021, Celsius filed for chapter following the steep decline of the crypto market throughout 2022, with bitcoin shedding greater than half of its worth from April to June.

The collapse of Celsius begs the query: is crypto lending nonetheless protected?

Nicely, there are numerous CeFi platforms that don’t present insured custody and should even mislead buyers, however greater gamers are keen on providing the very best merchandise with a deal with the safety of funds. Corporations like Binance or well-established manufacturers like Nexo are keen on sustaining their good repute, which positively impacts the protection of their crypto lending merchandise. It’s value mentioning that Celsius made some errors by investing their funds with out correctly diversifying their publicity, which isn’t the case for different gamers.

Elsewhere, DeFi crypto lending stays a protected various on condition that customers have full management over their funds.

One of many most important dangers each with CeFi and Defi lending platforms is the acute volatility of deposited cryptocurrencies, which might enormously have an effect on the worth of holdings in greenback phrases. Nevertheless, that is one thing that crypto lending platforms can’t management and should not answerable for.

Investor Takeaway

Crypto lending platforms may be an excellent avenue for making your digital belongings be just right for you. That stated, CeFi and DeFi lending platforms every have their benefits and downsides. Make sure to search for platforms which were round for a number of years, with a wonderful repute. And use our calculator to find out how a lot you’ll actually earn.

Need to make your crypto investments work even tougher for you? Subscribe to our Bitcoin Market Journal publication!