Bitcoin On-Chain Well being Stays ‘Net Positive’: ARK Make investments Report – BitRss – Crypto World Information

Though Bitcoin (BTC) on-chain well being stays internet constructive, from a worth perspective two essential assist ranges have to be maintained for a continued bullish uptrend, notes ARK Put money into its newest month-to-month report.

Bitcoin’s Wholesome On-Chain Metrics, What Does It Imply?

In its report, ARK Make investments posits that Bitcoin requires some upside if its market construction is to be maintained. The report notes that in August 2024, BTC’s worth slid by 8.7% to $58,972. The main digital asset was additionally unable to beat its 200-day transferring common, making two key assist areas at $52,000 and $46,000 vital for its bullish momentum.

The report states that regardless of the non permanent headwinds confronted by Bitcoin, its on-chain well being stays ‘net positive.’ Primarily, the Bitcoin community is internet bullish throughout completely different on-chain metrics equivalent to community safety, community utilization, and holder habits.

Bitcoin’s long-term holder provide, or BTC held for greater than 155 days by holders, is up 3.3% month-over-month (MoM) and down a marginal 0.23% year-over-year (YoY). As well as, Bitcoin’s locked provide has elevated in each MoM and YoY phrases by 0.58% and 1.82%, respectively.

Bitcoin’s transaction quantity has tumbled by 24.5% MoM and a couple of.3% YoY, a bearish on-chain indicator. Nevertheless, Bitcoin’s bullish on-chain metrics overshadow the one bearish indicator, permitting its on-chain well being to stay internet constructive.

One other key efficiency indicator strengthening ARK Make investments’s bullish stance on Bitcoin is its short-to-long liquidation dominance. Primarily, this metric measures short-term liquidations relative to long-term liquidations during the last 90 days, and located that it’s at its lowest since Q2 2023.

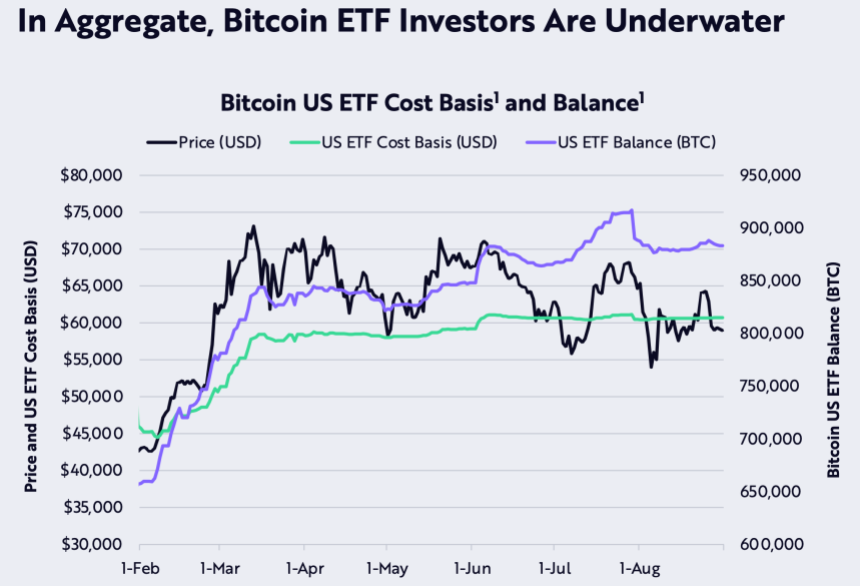

Bitcoin ETF Buyers Underwater At Giant

The report highlights that on the finish of August 2024, the estimated value foundation of US spot exchange-traded-fund (ETF) contributors was increased than BTC’s worth, hinting that the common ETF investor could also be at a loss. The upper estimated value foundation of US spot ETF contributors in comparison with its worth will be confirmed from the chart under.

The US Securities and Alternate Fee (SEC) accredited spot Bitcoin ETF earlier this yr, which made it simpler for institutional and retail traders to realize publicity to the world’s largest cryptocurrency by means of a compliant funding product.

Bitcoin ETFs are witnessing unprecedented curiosity from institutional traders. Particularly, Wall Avenue titans equivalent to Goldman Sachs and Morgan Stanley have poured hundreds of thousands of {dollars} into Bitcoin ETFs. Conversely, Ethereum ETFs haven’t but piqued institutional curiosity at comparable ranges.

At press time, Bitcoin trades at $57,836, up a minimal 0.2% previously 24 hours. BTC’s whole market cap stands at $1.14 trillion.