Ethereum Income Falls To A 4 Yr Low: Why Dismissing ETH Now Is Mistaken

Ethereum is beneath stress at spot charges. As of September 12, the second most precious coin struggled for momentum and caught beneath $2,400. The every day chart exhibits that ETH is promoting off steadily, and the zone between $2,400 and $2,800 is proving to be a robust liquidation area.

Ethereum Income Falls To Might 2020 Ranges

Past value motion, one thing is printing out. Based on observers, not solely is ETH value dumping but in addition a notable decline in income accompanying the sell-off. At press time, the every day income generated by the sensible contracts platform is at Might 2020 ranges.

To make clear, “revenue” refers to charges paid to validators each time they approve a transaction or execute sensible contracts on the chain. Whereas this can be a concern, some analysts are buoyant, saying Ethereum’s future, regardless of income challenges, is vivid.

This confidence stems from numerous developments. High of the checklist is the insistence that fuel charges on Ethereum are down and should not as dangerous as many assume. Over time, a number of implementations have been made to make mainnet transactions cheaper.

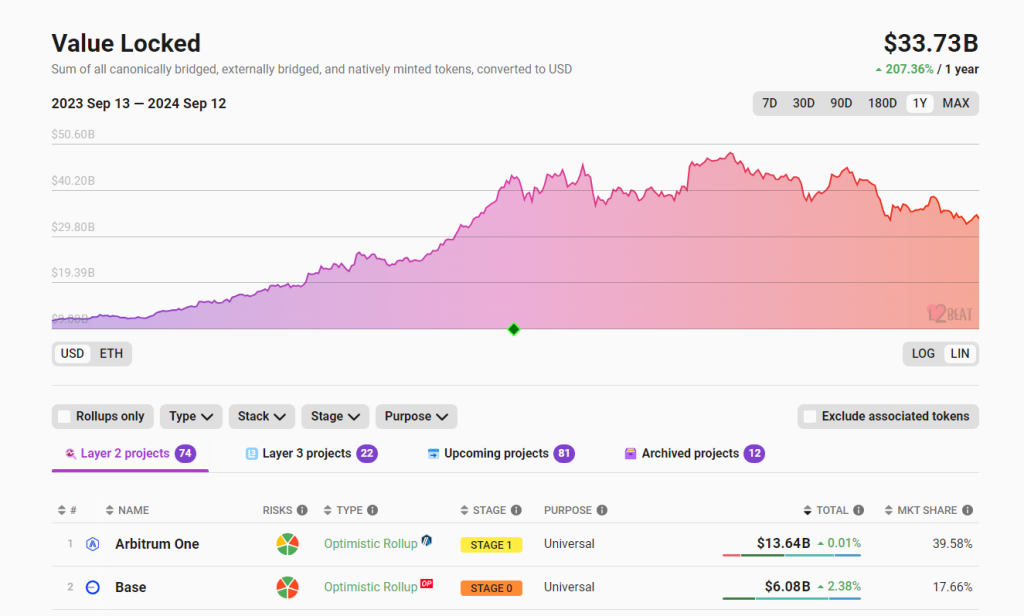

Following the congestion over the last bull run in 2020 via 2021 that pushed fuel charges to report highs, Ethereum builders pushed for layer-2 options. Platforms like Arbitrum, OP Mainnet, and Base now command billions in complete worth locked (TVL), L2Beat information, and gaining customers’ belief.

Most significantly, although these options route transactions off-chain, there have been no main hacks discouraging participation and questioning their safety.

Resulting from their reputation, prime technological corporations and crypto exchanges like Sony and Coinbase have been energetic. Coinbase already backs Base, whereas Sony plans to launch a layer-2, Soneium.

The Scaling Success, Steady Constructing And Refinement

The fast adoption of Ethereum layer-2 options to scale back the load on the bottom layer might clarify shrinking charges. Furthermore, the Dencun improve additional slashed layer-2 fuel charges, making these platforms even cheaper.

It’s this success Ethereum has had on issues of scalability that observers assume the platform’s future is promising. Earlier than layer-2s, Ethereum struggled to take care of customers as most couldn’t afford the excessive fuel charges, forcing them to options like Solana, Tron, and Avalanche.

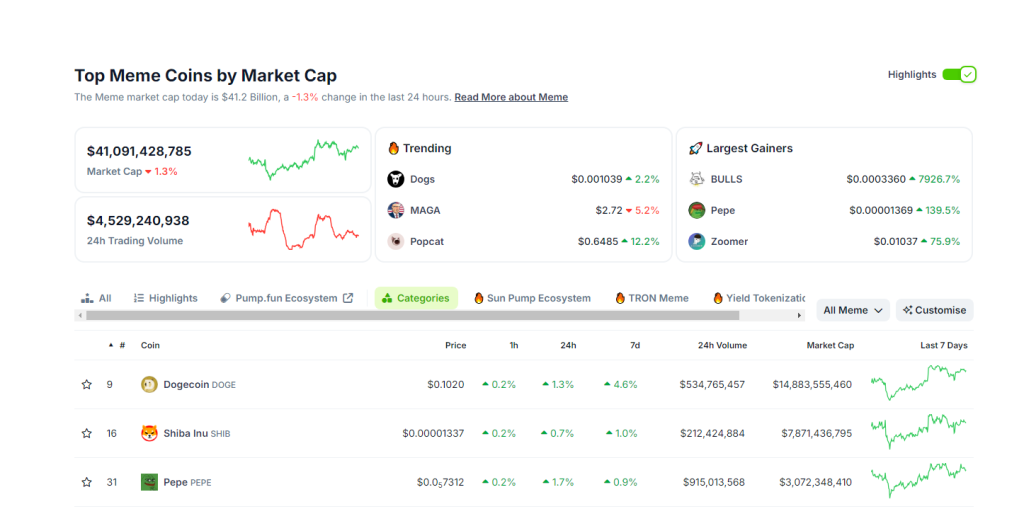

As a yardstick for achievement, meme coin exercise in Ethereum stays first rate even because it shrinks on Solana and shifts to Tron. Based on Coingecko, a few of the most precious meme cash, Pepe and Floki, reside on Ethereum, whereas others, like Brett, are on Base–a part of the community’s ecosystem.

The platform can also be constructing. After the transition to proof-of-stake after The Merge, the speedy goal is to scale on-chain.

Vitalik Buterin, the co-founder of Ethereum, mentioned this will probably be achieved in phases from Purge to Splurge. By the top, the platform would have carried out Sharding, permitting the platform to course of tens of millions of transactions each second with out off-chain strategies.